Automate your business finances and stay tax-ready year-round. Plus, get expert guidance for maximum deductions, guaranteed.*

One tool for self-employed finances and maximum tax-deductions

QuickBooks Solopreneur

QuickBooks Simple Start

Need different features? Explore other self-employed tools

Run your business, from books to taxes, all in one place

TurboTax experts can review your tax return, ensuring you file with complete confidence.

Easily view income, expenses, and profit with real-time reports and dashboards

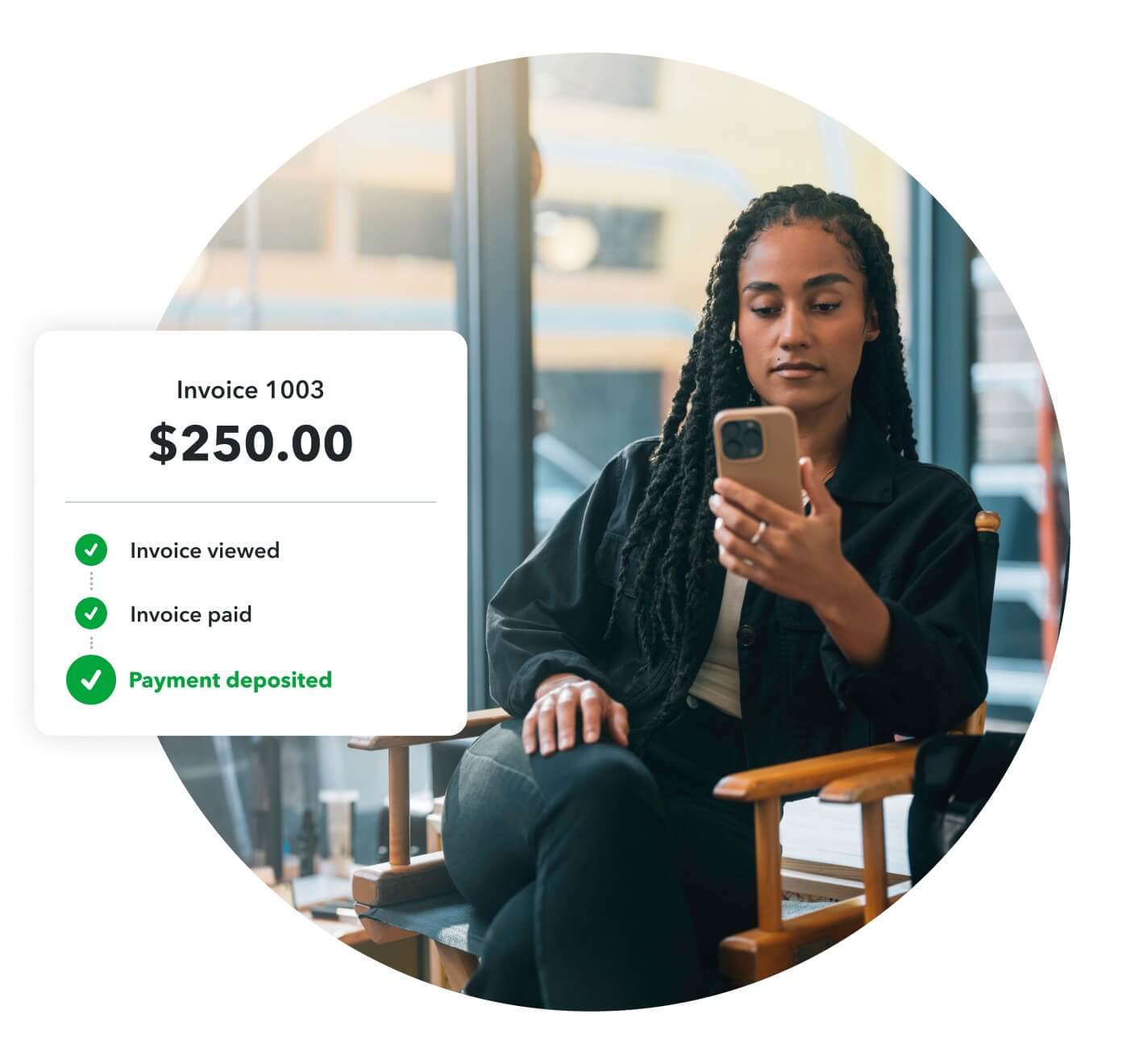

Snap photos of receipts, track mileage, send invoices and estimates, and more, with the QuickBooks Mobile app.*

Prepare your current tax year return with unlimited expert help and your maximum deductions, guaranteed. Pay only when you file.*

Exclusively for Schedule C filers—save time and effort by seamlessly moving from books to taxes in QuickBooks. Pay only when you file.**

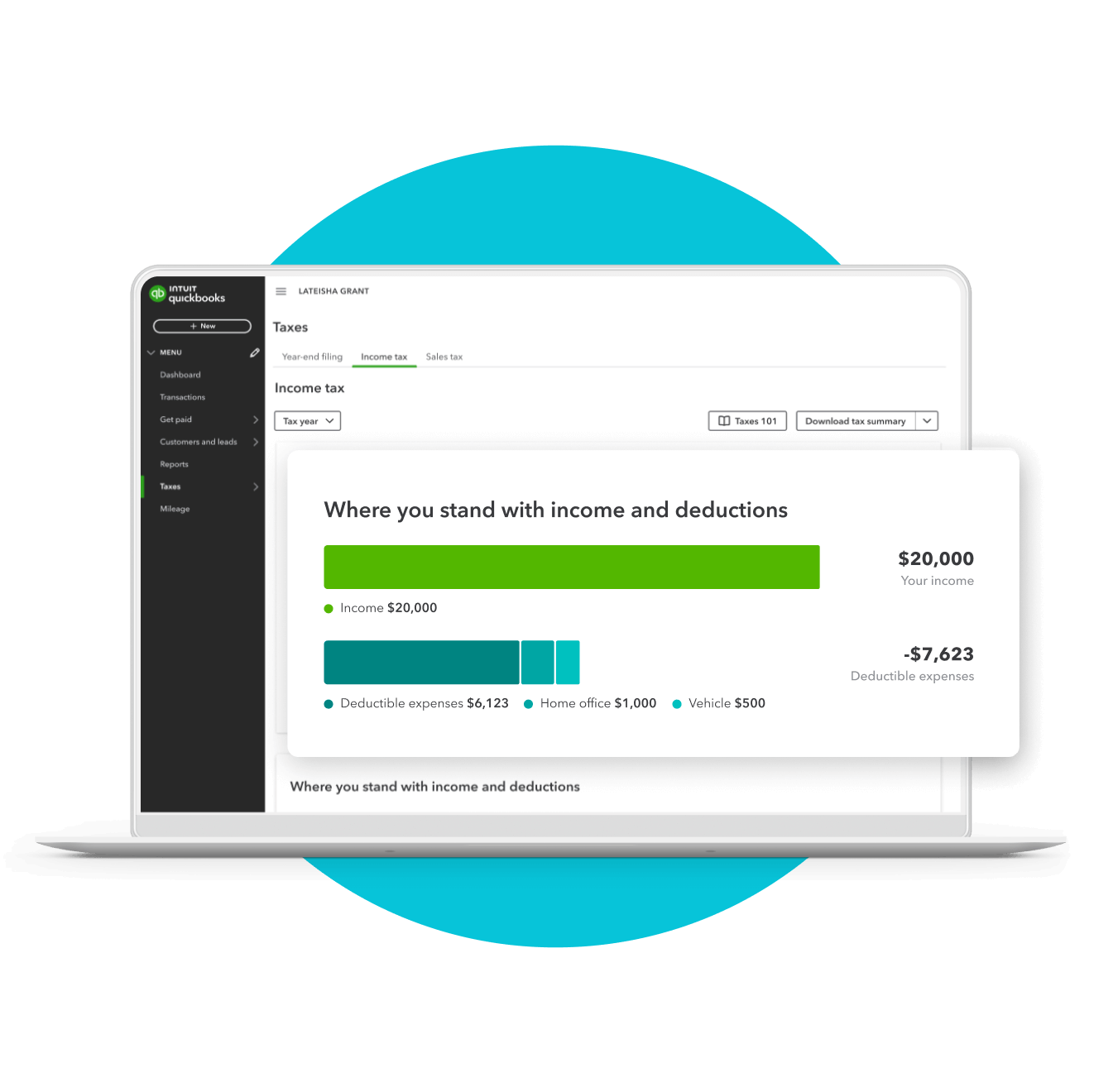

Year-round visibility into

your business, with maximum tax deductions

Maximum tax deductions

View where you stand year round, and prepare your tax return with live expert help for peace of mind.

Always know your cash flow

See your income, expenses, and profit all in one place, helping you feel prepared throughout the year.

Automatically separate business & personal

Business and personal expenses are automatically sorted into categories, so you can track your spending and maximize tax deductions.

Success is in the story

Success is in the story

See how other Solopreneurs are managing their businesses

Learn more about how to prep and file taxes, get paid, manage cash flow, and other self-employed topics