Best Payroll for Hourly Teams

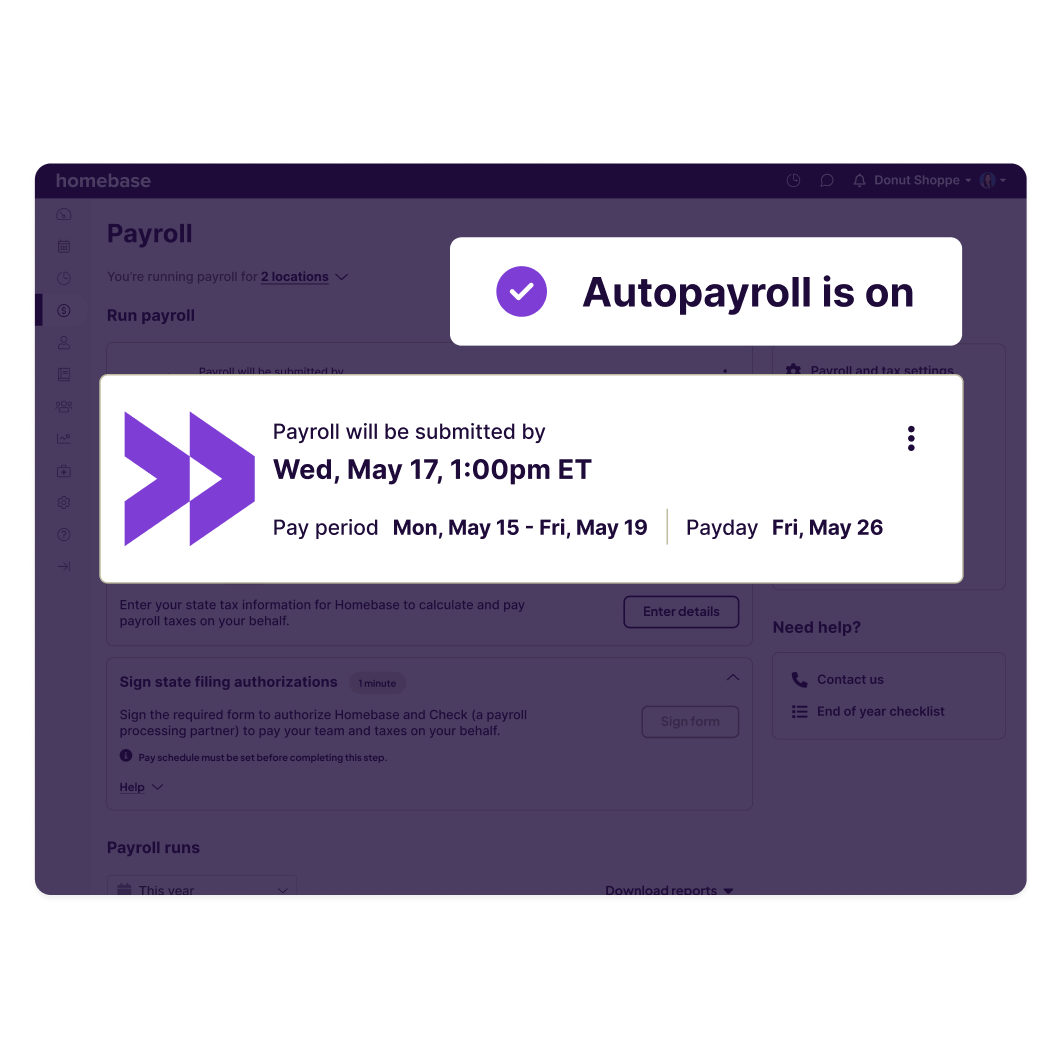

Run payroll even when you’re on the run. It’s that easy when your timesheets and payroll are all in one place.

No credit card required

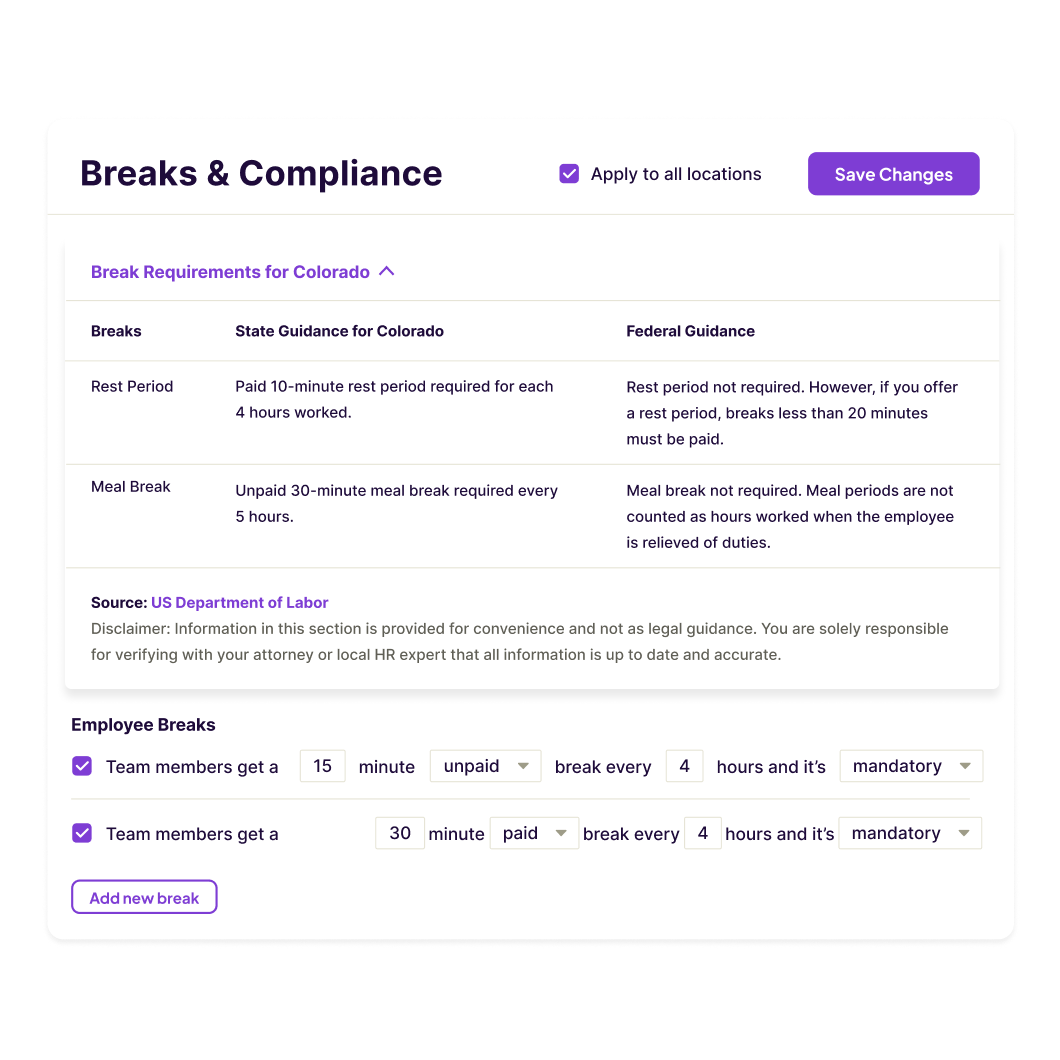

Homebase automates your payroll process, so you can stop calculating breaks and overtime and manually entering data for hours and wages.

Don’t wonder if you’re getting payroll right. Homebase helps you stay accurate and compliant with every payroll run:

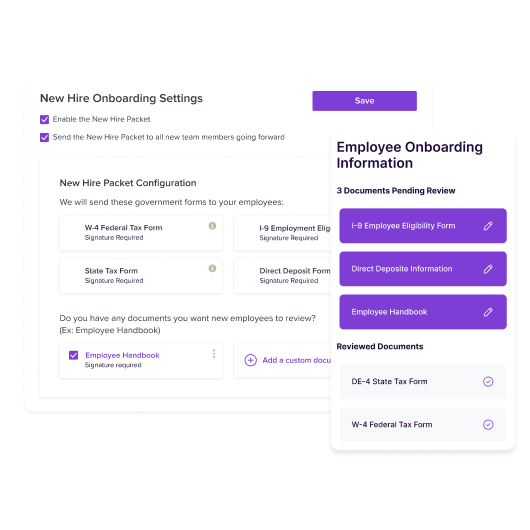

Get control. Get organized. Let Homebase handle all your docs, forms, filings, and payments.

As your business accelerates, you need payroll that can power your growth.

“I honestly have not thought about payroll since switching to Homebase Payroll—which is the best endorsement I can give a platform designed to make you more efficient or take away a once tedious task. WE LOVE IT.”

Owner at The Gear Attic,

Athens, GA

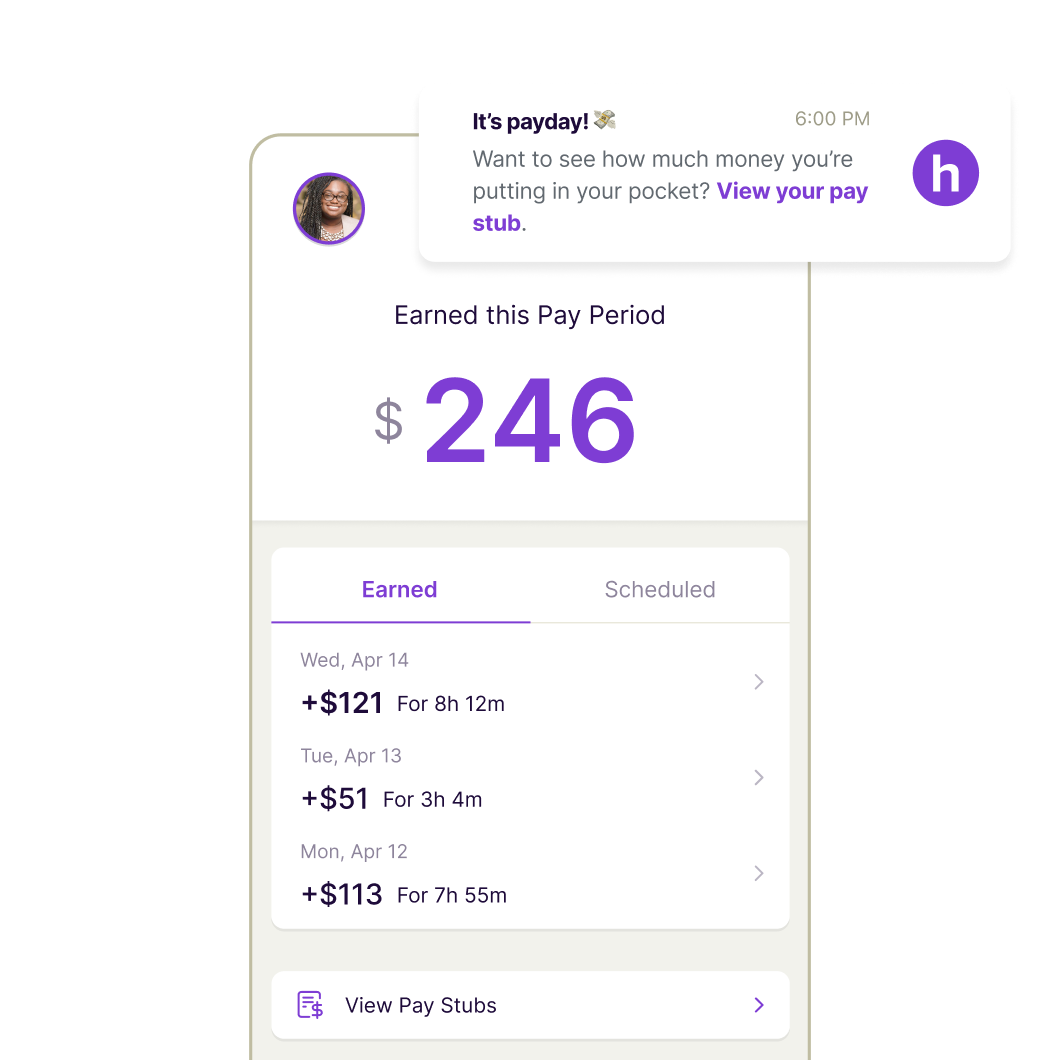

Offer your team the latest in payroll perks.

We’ll transfer your payroll data into Homebase for you. The switch is effortless.

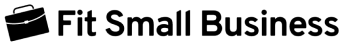

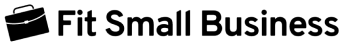

Timesheets and Payroll Make Great Teammates

Ditch the data entry, spreadsheets, and calculations. Get Homebase instead.

Get started and thank us laterWhat's included in payroll?

A complete hourly toolkit

Painless payroll

*Only available to locations with the same EIN. All locations must operate on the same pay schedule and pay frequency.

Tools for your team

How much does payroll cost?

We know how important transparent, predictable pricing is when you’re running a business. That’s why Homebase Payroll is $6/month per active employee + $39/month base fee.

Where is payroll currently available?

Payroll is currently available to US-based customers in all 50 states and Washington D.C.

How to run payroll

Small business payroll often results in a large headache as managers and owners learn how to do payroll manually. There are a lot of factors on the federal and state level you need to remember to prepare payroll for both hourly payroll and salaried employees every pay period.

However, with the Homebase payroll app, your payroll calculations are automated. This means that instead of pulling out your “payroll for dummies” pamphlet and poring over hours worked, social security numbers, and voluntary deductions, you can ditch the data entry since your online payroll information is covered by Homebase.

You don’t even need a time card calculator—Homebase converts your wages, hours, and minutes into your payroll summary report. Then Homebase calculates those wages and creates printable checks for you to send out to your team. You can alternatively have Homebase directly deposit funds into their bank accounts, marking yet another item off your to-do list, whether you’re running payroll for a restaurant or for any other business.

What is a good payroll example?

Your full-service payroll provider should save you time and reduce the risk of errors. Homebase makes that happen by keeping your data all in one place. Hours worked are instantly calculated, breaks and overtime are tracked, and it’s all synced to payroll so mistakes are easily avoided.

You don’t need to hang a payroll process flowchart in your office to run payroll successfully and avoid payroll fraud. Homebase lets you do it in a few clicks. Remember the days when you had to worry about Medicare tax, Social Security tax, health insurance, federal income tax, and other deductions? Those days are gone.

Control the chaos of hourly work.