Business checking accounts

Our checking accounts simplify your banking, so you can get down to business. Find an account that’s tailored to your needs, whether your company is new, growing or established.

Welcome offer:

Get up to a $500 bonusfootnote star with a new business checking account.

footnote star detailsCertain restrictions apply

Open a business checking account today

| No Value | ||||

|---|---|---|---|---|

| Free transactions per | Up to 100 transactions2 | Up to 200 transactions2 | Up to 500 transactions2 | Unlimited free incoming ACH transactions and incoming wire payments |

| Fee-free cash deposits per statement period | Up to $2,000 | Up to $5,000 | Up to $20,000 | Up to $1,000 |

| Monthly maintenance fee | $10/month | $15/month | $25/month | $10/month |

needed to waive monthly maintenance fee | $100 | $1,500 | $10,000 or $25,000 Monthly Combined Business Balance | $500 |

Checking accounts for businesses with unique needs

For large businesses with complex banking needs

No monthly maintenance fee for non-profits

Open a checking account online in 3 simple steps

Check that you’re eligible

Corporations (S and C), limited liability corporations (LLCs), and sole proprietors can apply for some accounts online.Apply in minutes

Apply online in minutes and get a decision on the spot. Get ready to apply with our Business Documentation Checklist.Verify your ID with a selfie

To finalize your application, we may ask you to take a photo of your ID and snap a selfie to verify your identity without a branch visit.

Business checking accounts FAQs

Business checking accounts Frequently asked questions

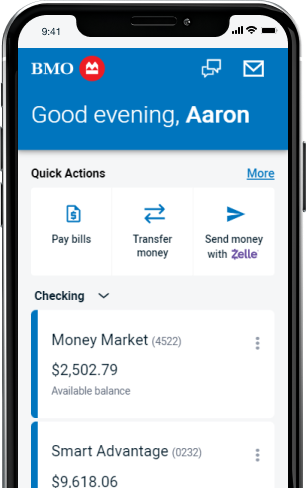

We make digital banking simple and safe

Manage your business banking from anywhere with our easy-to-use digital banking tools.

Streamline your billing process

Simplify your entire billing process with B M O Bill ConnectManage all your accounts

Simplify your banking with Total Look. Manage all your accounts in one place, create budgets and track expenses.

We’ve got all your business banking needs covered

Business credit cards to help manage your cash flow

Simplify purchases, keep your personal expenses separate and earn rewards.Flexible lending to support your business

Get the funding you need to make your business goals a reality.Card payment services to boost sales

Make it easy for your customers to pay by accepting card payments anytime, anywhere.

Take the next step toward better business banking

- Definitions of Capitalized Terms

- footnote 1 details Please read Interest Rates and Calculations for information on interest on deposit accounts.

- footnote 2 details Each additional transaction is $0.40. Transactions means non-ATM deposits, checks deposited, checks paid, and ACH credits and debits.

- footnote 3 details $0.40 for each check presented for payment against the account. Deposits made at a branch, by mail, by lockbox or as a “check deposit package”: $0.40, plus an additional $0.40 for each check included in the deposit.

- footnote 4 details A charge of $0.25 per $100 will be charged when coin and currency deposit threshold is exceeded.

- footnote 5 details If you make an Internal Transfer on a weekend or holiday, we'll credit the payment the same day, but we'll post the payment on the next Business Day.

- footnote 6 details Message and data rates may apply. Contact your wireless carrier for details.

- footnote 7 details U.S. checking or savings account required to use Zelle®. At BMO we require you to enroll in a checking account to use Zelle® for your small business. Transactions between enrolled users typically occur in minutes. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution’s online or mobile banking experience. Zelle® should only be used to send money to people and businesses you trust. Zelle® does not offer protection for authorized payments, so money you send may not be recoverable. For additional details, see the BMO Digital Banking Agreement found at bmo.com/uslegal

- footnote 8 details Mobile Deposit is available using the BMO Digital Banking Mobile App. This service may not function on older devices. Users must be a BMO Digital Banking customer with a BMO account opened for more than 5 calendar days. Deposits are not immediately available for withdrawal. For details, please see the BMO Digital Banking Agreement found at bmo.com/uslegal

- Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.